Time limit for filling Far Back Taxes

How Does A Fixed-Rate Mortgage Operate, And What Is It?

Describe PMI. The Operation of Private Mortgage Insurance

Costs of In Vitro Fertilization and Possible Financing Options

Mortgage forbearance agreements are contracts that are formed between a mortgage lender and a borrower who is behind on their payments

Read our comprehensive guide to leverage the knowledge of market value, budget assessment, strategic timing, negotiation techniques, trade-ins, and financing to secure the best deal in your car-buying journey. Equip yourself to make a savvy investment and drive home with the car of your dreams without breaking the bank.

Explore our comprehensive guide on the home buying process, where we delve into various types of loans, financing options, government programs for first-time homebuyers, and available tax benefits. Make your dream home a reality with the right information and preparation.

Learn about no-credit-check loans, how they work, and how to prepare for one. Discover how to compare lenders, improve your credit score, and plan your finances effectively. Our comprehensive guide is designed to help you make informed financial decisions.

To qualify for a personal loans with low-interest rates, you should have a high credit score. Various loan options are available, so it's vital to weigh interest rates, fees, loan amounts, and payback terms.

Receiving a loan may be a realistic choice for many firms and people, allowing them to have access to fast cash that can be used for various requirements, including those related to their business and personal lives. However, there is no single loan that can accommodate everyone's needs.

A letter of credit, sometimes referred to as a credit letter, is a statement provided by a financial institution such as a bank that assures the payment of a certain amount in a business agreement. An unbiased third party is involved in the process, which is significant.

Mainly introduce four channels through which GCS affects financial stability, they respectively are: use GCS as a general value store, widely used for payment, risk exposure of financial institutions and confidence coefficient magnification.

The average interest rate for a 30-year stabilized mortgage hit its highest level in 20 years in the first few days of November, and it's likely to keep going up this month. Experts on mortgages still talk about inflation and how the Federal Reserve is trying to stop it. Prices at the store are 8.2% higher than they were a year ago. In response, the Federal Reserve raised its key interest rate for the sixth time this year.

To be eligible for a refinance, you will need to have adequate income, credit, and equity in your home and satisfy the minimal requirements set by the lender.

The acquisition of an investment property may be challenging due to the several revenue streams generated from renting or reselling the property.

Independent from the IRS and reporting exclusively to the National Taxpayer Advocate, the Taxpayer Advocate Service (TAS) is there to represent taxpayers' interests. The agency defends the legal interests of taxpayers in instances of tax controversy. If a taxpayer has exhausted all other options in resolving an issue with the Internal Revenue Service, they can ask for help from the Taxpayer Advocate Service

To purchase a new automobile, you must exchange a sizeable sum of money and several signatures at the car dealership. Even if the hard work has been done, the task is not yet over. The choice to purchase an extended warranty is still up to you. The purpose of this post isn't to tell you if buying a warranty is a good or terrible idea, but we have some advice that may help you choose whether an extended warranty is the correct choice for you. A vehicle's extended warranty serves as insurance for it, protecting you against pricey, unanticipated repairs. It provides coverage for repairs for a specified number of miles and times

undefined

What Is Form 1065

What Are Securities Backed by Commercial Mortgages?

Financial Pitfalls to Dodge When Exiting a Job

To Lease or to Buy: Decoding the Car Dilemma

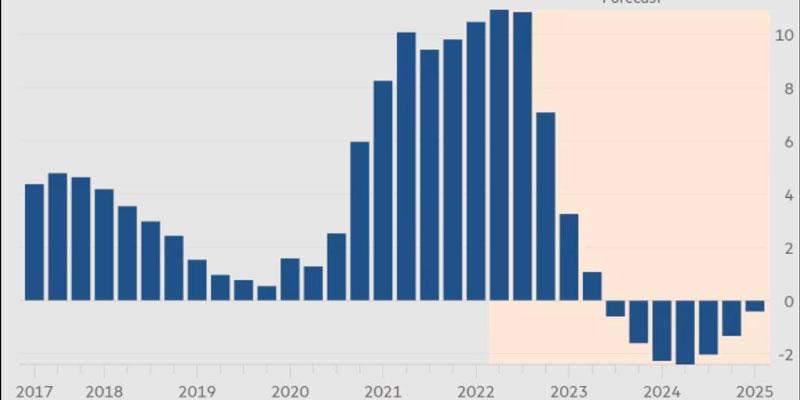

Why Americans are Rushing to Claim Social Security Benefits?

Delaying Gratification: Why Filing For Social Security at 67 Makes Sense?

All About Graduate Student Loans

Understanding of Financial Situation for Mortgage Payments

All You Need to Know About Life Insurance

How to Get Out of Debt in 4 Simple Steps?