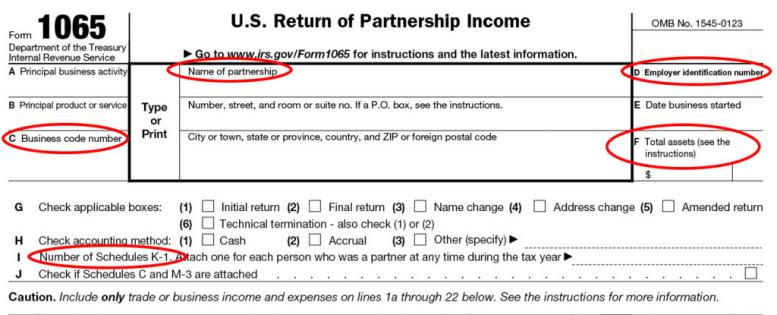

Form 1065 U.S. Return of Partnership Income is a tax form issued by the IRS and is used to record the earnings loss deducts credits and profits of a partnership. Alongside Form 1065 for partnerships, they should also file Schedule K-1 as a separate document for each partner. Form 1065 offers the IRS an overview of the company's financial situation for the current year. The partners are required to declare and pay taxes on their share of the income earned by the company on a tax return. The partners must pay income tax for their income, regardless of how the profits were dispersed.

What the Form Reports

Page One

The basic information regarding the partnership (name, address, address, identification number, the business's name, dates when the company was established) is listed in the middle of the document. The partnership will then indicate if the return is a special one (e.g., amended or final, indicating a change in address or name) as well as the accounting method and the number of schedule K-1s included.

The income section lists various income-producing items derived from the business or trade of the partnership, including gross receipts from sales as well as a net gain or loss resulting from the disposal of assets belonging to the business (a figure derived from Form 4797). Certain items require particular treatment when it comes to the shareholders' (partners') own return; they are called separate declared items and are not included on the first page of Form 1040. For instance, due to specific rules applicable to rent real estate and deductions, you will not be able to see the entry of these rents on the income section of the Form 1065 tax return.

Similar to this, although certain of a partnership's business or trade deductions are noted on the first page of Form 1065. However, other deductions are reported in other places (e.g., charitable contributions or the Sec. 179 deductions) for partners to use their own rules for the write-offs. The deductions on page one of Form 1065 are for wages and salaries paid to employees (but the partners are not employees; therefore, payments to them aren't included here), and any payments guaranteed to partners are also listed.

The gap between the partnership's total income and the total deductions it receives is the normal business income profits or losses. The net sum, as well as other elements, is distributed to the partners. The bottom of the page is used to sign and mark the return if the return is prepared in papers (electronic signatures are required to sign returns that are electronically filed) and also for noting the name of an employee who is paid to prepare the return if one exists.

Pages Two and Three

Schedule B, other Information, is an array of questions concerning the partnership. For example, look in the box to answer question one concerning the type of partnership or entity filing the return, like an LLC with at least two partners or an LLP with limited liability. Schedule B also gives information on the Tax Matters Partner, an individual appointed as a partner by the organization to sign the returns and communicate with the IRS regarding the return. (If there are over 10 partners, all audits should be carried out at the partnership level to spare the IRS the headache of auditing every single partner on handling the partnership item.)

Page Four

Schedule K contains the distribution shares of partners of the items. This is the schedule for allocations for the partners for the items listed. The allocations are listed on Schedule K-1. It has sections for:

- Income (Loss)

- Deductions

- Self-Employment

- Credit

- Foreign Transactions

- Alternative Minimum Tax Items

- Other Details

Page Five

The analysis of Schedule K's net income (loss) is broken down into loss or income based on the type of partnership (corporate or individual (active) or individual (passive) and so on). The report further separates the income and loss between limited and general partners.

The balance sheet is Schedule L. The books make the entries for the assets and liabilities of the partner. Similar to every balance sheet amount between the liabilities and assets effectively represents the capital balances (i.e., capital in the company).

Reconciliation is made on Schedule M-1 of the income or loss as recorded in the books and losses or income per return. Since tax laws don't always reflect the actual economics of partnerships, reconciliation is required. For instance, although partnerships can deduct the entire expense of meals and entertainment in their accounts for tax purposes, the partnership can only deduct 50% of the costs; the reconciliation is done by completing Schedule M-1.