There is no doubt that Bitcoin is not a currency at this stage. But will Bitcoin become currency in the future?

Currency has four major characteristics: universal acceptance, payment tool, storage method, and measurement unit. We might as well imagine whether in the future, Bitcoin will meet these characteristics and become a real currency.

1. Universal acceptance

A person is willing to accept a thing as a price for selling goods or providing services. The fundamental reason is that he believes that this kind of thing can be spent smoothly and can buy the goods or services he needs. At this stage, there are too few organizations that can use Bitcoin. But what about the future? People's lives gradually move to the Internet, and the demand for online payment will continue to grow explosively. If Bitcoin continues to vigorously promote its currency properties, and strives to allow more online merchants to accept Bitcoin, it is possible to achieve the requirement of universal acceptance.

2. Payment tools

Currency as a payment tool, the main consideration is the convenience of payment. Unfortunately, Bitcoin's payment convenience has not been much improved compared to traditional online banking or third-party payment tools. On the contrary, in some cases, its convenience is not even as good as traditional payment methods. It is mentioned in the official Bitcoin website that the reliability of instant transactions is poor. It is recommended to wait for 10 minutes for small transactions to be confirmed, and wait for 60 minutes or even longer for large transactions.

transaction data at individual points may be "lost" due to slow processing, resulting in unsuccessful transactions. In this case, if Bitcoin is adopted on a large scale, and the number of "points" and the number of transactions have both increased significantly, it is likely that transactions will fail frequently, which means that the waiting time for confirmation needs to be extended, resulting in a decline in transaction efficiency.

If this is the case, Bitcoin will lose the market for small instant transactions, which is precisely the most frequent type of transaction in daily use, whether online or offline.

One possible solution is to establish one or more transaction processing centers (corresponding to bank clearing centers) to improve the processing capacity of these points, and broadcast transactions through these points for the first time, let them provide fast and reliable transaction confirmation in most cases. But isn't this a denial of the exciting "point-to-point" feature of Bitcoin?

For Bitcoin to meet the requirements of payment instruments, it depends on how it develops.

3. Storage method

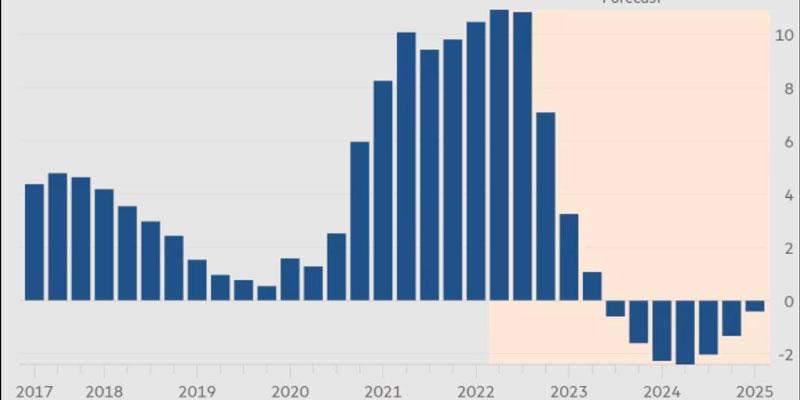

For a currency to meet the storage requirements, it needs a relatively stable value (including mild inflation and deflation). If the value is unstable, people will look for other currencies with stable values to substitute. This is true for high inflation (people tend to abandon high inflation currencies), and the same is true for high deflation (people tend to hold high deflation currencies instead of using them, that is, high deflation currencies tend to stop circulating).

The inflation and deflation of a currency are determined by the demand and supply of that currency. If Bitcoin gradually develops into a currency, then the demand for it will have a very rapid growth; superimposed on the growth of the Internet economy itself, the growth rate of demand for Bitcoin will be very alarming. And the total supply of Bitcoin will reach the upper limit at some point in the future (even if there is a Bitcoin "bank", due to the limit of the total supply, the bank’s currency manufacturing function will also have an upper limit); and before that, its supply growth rate was diminishing. Under such conditions, assuming that Bitcoin becomes a currency, its value will continue to rise foreseeably, that is, it will face continued deflation. This will prompt it to launch the circulation field, lose this function as a payment tool, de-monetize, and become a collectible.

From this point of view, the prospect of Bitcoin as a currency is not good.

4. Measurement unit

This is very easy to understand. It is the unit of measurement for the price of commodities. There are already goods and services priced in Bitcoin. From this point of view, Bitcoin meets the requirements.

Based on the above four points, the possibility of Bitcoin becoming a currency in the future is very bad. I personally prefer Bitcoin to develop into a collectible.