Loans for home purchases come in a wide variety of terms and conditions. While some homeowners choose ARMs, fixed-rate mortgages are considerably more common. Nonetheless, several choices exist even among fixed-rate loans. Here, you will find all the information you need to make an informed decision, such as which fixed-rate mortgage product is right for you. Mortgage loans, whether for a home or a business, are a sort of secured debt with a set interest rate. A fixed-rate mortgage is one in which the interest rate is agreed upon in advance by the borrower (the debtor) and, indeed, the lender (the creditor) and remains constant (hence the name "fixed-rate") during the life of the loan.

When a borrower puts down less than 20% on a property, conventional mortgage lenders typically require them to obtain private mortgage insurance (PMI). Private mortgage insurance (PMI) is insurance for the lender against the borrower's default on a house loan.

Paying out of pocket for in vitro fertilization (IVF) can cost tens of thousands of dollars if your employer's health insurance plan doesn't cover fertility treatments or if you don't have health insurance via work. And unless you have a sizable emergency fund, you'll need to figure out how to pay for it

This blog provides a detailed overview of various loan options for starting a business with no money and offers useful advice on applying for loans, avoiding common pitfalls, and finding the best lenders. A must-read for budding entrepreneurs looking at financing options.

Mortgage forbearance agreements are contracts that are formed between a mortgage lender and a borrower who is behind on their payments

Explore our comprehensive guide on the home buying process, where we delve into various types of loans, financing options, government programs for first-time homebuyers, and available tax benefits. Make your dream home a reality with the right information and preparation.

Learn about no-credit-check loans, how they work, and how to prepare for one. Discover how to compare lenders, improve your credit score, and plan your finances effectively. Our comprehensive guide is designed to help you make informed financial decisions.

To qualify for a personal loans with low-interest rates, you should have a high credit score. Various loan options are available, so it's vital to weigh interest rates, fees, loan amounts, and payback terms.

Receiving a loan may be a realistic choice for many firms and people, allowing them to have access to fast cash that can be used for various requirements, including those related to their business and personal lives. However, there is no single loan that can accommodate everyone's needs.

A letter of credit, sometimes referred to as a credit letter, is a statement provided by a financial institution such as a bank that assures the payment of a certain amount in a business agreement. An unbiased third party is involved in the process, which is significant.

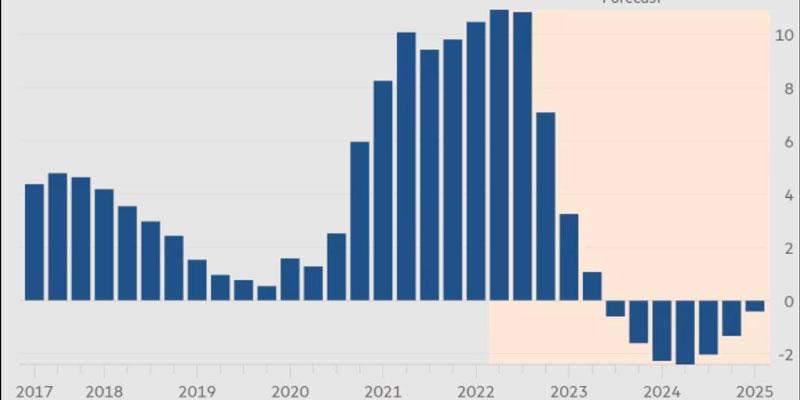

The average interest rate for a 30-year stabilized mortgage hit its highest level in 20 years in the first few days of November, and it's likely to keep going up this month. Experts on mortgages still talk about inflation and how the Federal Reserve is trying to stop it. Prices at the store are 8.2% higher than they were a year ago. In response, the Federal Reserve raised its key interest rate for the sixth time this year.

To be eligible for a refinance, you will need to have adequate income, credit, and equity in your home and satisfy the minimal requirements set by the lender.

The acquisition of an investment property may be challenging due to the several revenue streams generated from renting or reselling the property.

To purchase a new automobile, you must exchange a sizeable sum of money and several signatures at the car dealership. Even if the hard work has been done, the task is not yet over. The choice to purchase an extended warranty is still up to you. The purpose of this post isn't to tell you if buying a warranty is a good or terrible idea, but we have some advice that may help you choose whether an extended warranty is the correct choice for you. A vehicle's extended warranty serves as insurance for it, protecting you against pricey, unanticipated repairs. It provides coverage for repairs for a specified number of miles and times

MBSs may be issued by government entities or sponsored businesses, central banks, and private investment banks. Government-backed major participants in the US include Ginnie Mae, Fannie Mae, and Freddie Mac. They are crucial to keeping the liquidity in check.

We collected data from 14 student loan businesses that offer graduate student loans in at least 25 U.S. states and assessed them across 12 data points in the categories of interest rates, fees, loan terms, hardship choices, application procedure and eligibility. The ones with three stars or more were selected as the greatest examples to showcase

Possibly, the state institution of your dreams is located in a different U.S. state. Compared to in-state students, the price of attending as a nonresident is significantly higher. You may make your chosen college your permanent residence before or after enrolling. It's not the simplest solution, and it may not be the most effective method to save costs in school

When you begin collecting, you receive a decreasing amount of Social Security benefits based on your salary, length of employment, and age. Whenever the Consumer Price Index rises, so too do Social Security payments. Incorporating a spouse into your Social Security calculation raises your benefit by 1.5 times the amount you would receive on your own. Warning: This tool only takes into account one income per household.

There are several loan characteristics to consider when applying for a mortgage. The choice between a fixed-rate and an adjustable-rate loan is an important one. ARMs' lower beginning rates make them enticing in today's rising-rate climate, but they come with a hefty price tag: substantial risk. Each loan has advantages and disadvantages, so your decision should be based on your financial situation, housing demands, and risk tolerance.

Uncover the intricacies of a Home Equity Line of Credit (HELOC) in our comprehensive guide. Understand eligibility, interest calculation, pros and cons, and alternatives to make an informed decision about your financial future.

When determining the amount of money you may borrow for a mortgage, one of the primary considerations lenders give weight to is your income. Find out how much income you need to make to be eligible.

An income statement item known as a loan loss provision is put aside to cover uncollected loans as well as loan payments. A bank's total financial health must be accurately assessed by taking into account possible loan defaults and other costs. Provisions for loan losses are included in loan loss reserves, a line item on the balance sheet that shows the total amount of loans that have been lost.

Home equity lines of credit are available to homeowners who want to use the equity they have built up in their houses as a source of financial support.

Navy Federal Credit Union, one of the nation's largest credit unions, has over 10 million members and 300 sites worldwide. Mortgages, refinancing, and home equity loans are just some of the presented financial options